Line 59: "Let me tell you how it will be."

A commentary

IKEA opened its first northeast enormostore just outside of Newark, New Jersey, in 1990, at a time when the sales tax there stood at four percent. The company filled New York City subway cars with signs enticing the locals to take a ride over the bridge where they could buy all the things they need and save a bundle on sales tax (the combined New York state and city rate at the time hovering around eight percent). Legend has it Albany was none too pleased by this tax-evading subterfuge and instructed staff from the Tax Department to prowl IKEA’s parking lot to take pictures of New York license plates. They’d match DMV records to the photos and send a letter to the registered owner with a friendly reminder that if they had purchased anything while out-of-state, they were obliged to report that to New York and cough up the “use tax” they had evaded by shopping in New Jersey.

Over the years, we’ve heard occasional denials that such activity ever took place.

Of course it didn’t!

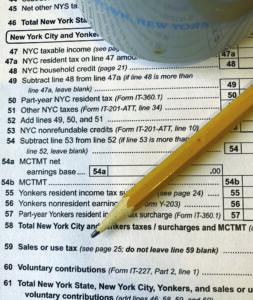

No, instead we have LINE 59 on our annual state income tax return. From the instruction booklet we read this declarative: Report your sales or use tax liability on this line. Do not leave Line 59 blank.

If you use store-bought tax return software and try to enter a zero on LINE 59, it comes back as an error.

I was present at the birth for Line 59, advocating for it in my previous life as the lobbyist for New York’s brick-and-mortar retailers. This was in the early 2000s when Internet-only merchants were starting to ransack the retail

You have reached your limit of 3 free articles

To Continue Reading

Our hard-copy and online publications cover the news of Otsego County by putting the community back into the newspaper. We are funded entirely by advertising and subscriptions. With your support, we continue to offer local, independent reporting that is not influenced by commercial or political ties.