BVA Task Force Enlists SFCU for Banking Services in Morris

By TERESA WINCHESTER

MORRIS

The Butternut Valley Alliance has achieved the nigh to impossible. It has responded to the national epidemic of branch bank closures in general, and to the closing of the Morris branch of Community Bank, NA in particular, by securing new banking services for the Butternut Valley—services from which much of western Otsego County will benefit.

According to U.S. government data from the Office of the Comptroller of the Currency, more than 220 bank branches closed in the United States in January and February of this year. If banks across the U.S. continue to shut down at the current rate, approximately 1,300 will close by the end of 2024, the OCC finds.

Following the national trend, CBNA has, in the last four years, closed a total of 44 branches, many of them in rural or underserved communities. Closures in Otsego County have occurred in the towns of Otego, Milford and Schenevus. CBNA has also closed banks in the Delaware County towns of Downsville and Fleischmanns. On January 19 of this year, CBNA closed its doors at 132 Main Street, Morris, thus ending 167 years of banking at that location, vacating a handsome stone building listed on the National Register of Historic Places and delivering a sucker punch to the vitality of the village.

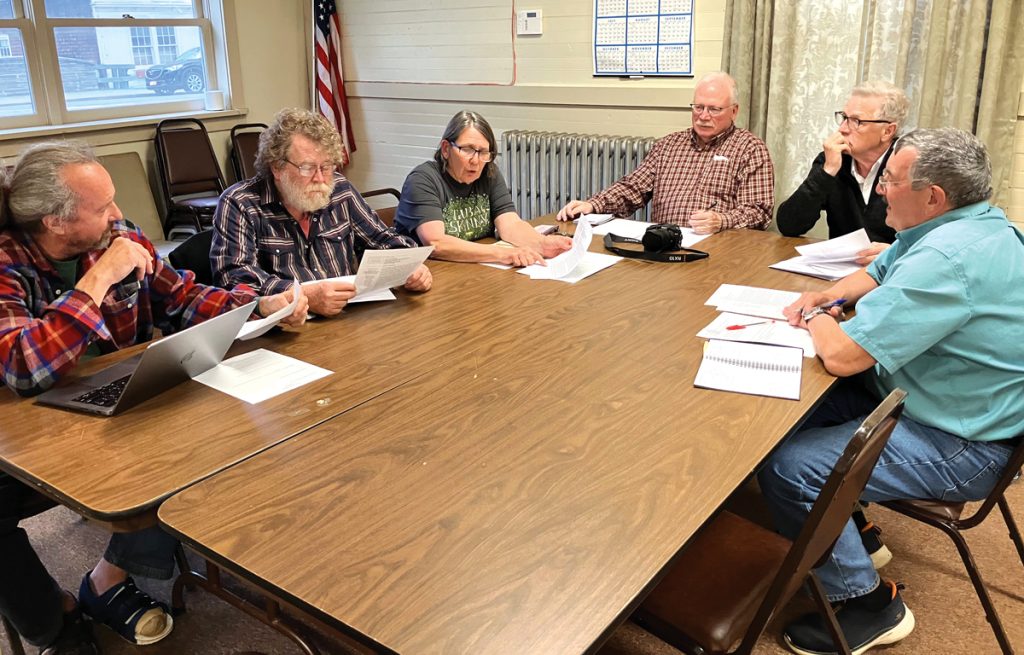

Five months after CBNA’s closing in Morris, the BVA has announced a partnership with Sidney Federal Credit Union. SFCU will now take the necessary measures to open a full-service branch in Morris. This development comes as a result of proactive steps taken by the “Save Our Bank” task force, composed of BVA board members Ed Lentz, Bob Thomas, Tom Washbon, Jason Cianciotto, Peter Martin and task force leader Maggie Brenner. Task force members at large are former Town of Morris Supervisor John DiStefano, Jim Tremlett, Arlene Martin and Andrea Hull.

To reestablish banking services based in the Village of Morris, the Save Our Bank task force sent a statement of need to more than 15 financial institutions to explore their interest in expanding operations to the Butternut Valley.

The criteria outlined in the statement of need included:

- Matching interest rates and other account benefits for Community Bank account holders who might transfer their accounts to a new provider;

- A night depository or some ability to safely hold daily cash transactions for businesses;

- An ATM or no-charge cash access, check depositing and cashing capability for residents;

- Access to cash for businesses (making change, filling tills);

- Ability of towns and villages to make large deposits (cash and checks) within 24 hours of receipt;

- Affiliation with a nearby brick-and-mortar facility for other banking needs, such as financial guidance to residents and businesses.

Requests for proposals were sent to the three institutions that responded favorably. The two institutions under final consideration met all these criteria.

“In the end, it came down to a choice between two credit unions, both of whom were able to meet the needs of Butternut Valley residents, businesses and municipalities,” said Ed Lentz, BVA chair and member of the task force. “It was a tough choice, but we ultimately decided that, on balance, and taking into account the local name recognition of SFCU, partnering with SFCU was the best decision for our community at this time.”

“We look forward to serving the residents of the Butternut Valley and welcoming them to the experience of how SFCU is making banking easier,” said SFCU Chief Executive Officer Jim Reynolds, who added that SFCU is currently one of the fastest growing credit unions in New York, with a membership of more than 70,000 and assets totaling more than $980 million.

SFCU is applying to the New York State Department of Financial Services for designation as a Banking Development District. This designation will make the branch opening financially feasible and, notably, will also allow municipalities to bank with the credit union. In general, New York State law prohibits municipalities from banking with credit unions; however, with the initiation of the BDD program, the law was amended to allow municipalities that support a BDD application to bank with the partnering credit union.

While the BDD process can take six to 12 months, SFCU plans to begin offering limited services in the very near future by appointing a business development representative to assist businesses and residents in opening accounts. Opening a temporary field office is a possibility.

SFCU is headquartered in Sidney. An overview provided on Linkedin.com states, “SFCU is a full-service financial institution providing the tools and resources members need to make banking easy and convenient.” The same source also states, “SFCU membership is open to anyone who lives, works, worships or attends school in Chenango, Cortland, Delaware, Essex, Fulton, Hamilton, Madison, Montgomery, Onondaga, Otsego, and Schoharie counties and portions of Broome, Oneida, and Herkimer counties.”

At the time of its announced closing, CBNA’s motto, “Bank Happy,” did not resonate with Morris bank customers. The “nearby location” CBNA offered up in its October 2023 letter is 28 miles round trip from the Morris branch. Local residents expressed concerns about the elderly in the community who did not drive, those who were not computer-savvy enough to switch to online banking or who preferred to bank in person rather than online, and the thriving Amish community whose members do not operate motorized vehicles. Treacherous winter road conditions between Morris and Oneonta were also a concern.

CBNA’s departure also poses an inconvenience for area businesses and municipalities, requiring them to travel greater distances to make their deposits, thus increasing transportation costs. State law mandates that town clerks and town courts deposit monies received within one business day.

Town of Butternuts supervisor Bruce Giuda responded with unrestrained enthusiasm to the announcement about SCFU services, stating in an e-mail communication:

“I would like to recognize the tireless efforts of the Butternut Valley Alliance task force on the creation of this Banking Development District. It is truly a testament to the power of local folks in local communities who are looking out for their neighbors. The BVA has met the challenge by overriding the motives and actions of Community Bank, which has disregarded and abandoned all the residents and businesses in the Butternut Valley. I will definitely be meeting with Sidney Federal Credit Union representatives to discuss establishing a new banking relationship between them and the Town of Butternuts. I highly recommend that all the residents and businesses in the Butternut Valley do the same, which will strengthen the new SFCU branch in Morris. Many thanks to the leadership of Ed Lentz and the rest of those involved in this remarkable accomplishment.”

Save Our Bank task force leader Brenner looked back on the group’s work with the satisfaction of a job well done.

“When the task force began its work nearly six months ago, it really felt as if we were butting our heads against an impenetrable corporate brick wall, but it turns out we became ‘the little alliance that could.’ It shows what can be accomplished when a dedicated group of individuals with diverse skills, but all with a commitment to the welfare of their community, come together with a focused mission. Our next challenge is to work with CBNA to try to ensure that the historic building it formerly occupied is put to good use for the Butternut Valley community—to preserve that component of our legacy,” Brenner said.