The Myth Busting Economist by Larry Malone

Inflation Likely To Rise as New Policies are Enacted

An earlier column this year asked “Where Did All of the Inflation Come From?” A big myth was busted when we discovered that the origins of recent inflation dated to Trump’s Tax Cut and Jobs Act, which injected $2.3 trillion into an economy with a 4 percent unemployment rate in 2019.

Putting a record breaking corporate tax cut into a thriving economy increased the inflation rate from 1.9 percent in 2018 to 2.3 percent in 2019. With inflation above the Federal Reserve’s 2.0 percent target, the Fed responded by raising its Federal Funds rate FOUR times in 2019. Higher interest rates made the cost of borrowing for homes, boats, snow machines and college rise even more.

The impending change in presidential administrations, and a big shift in economic policies, will make it possible for us to track the inflationary effects of the latest Trump proposals. We’ll nip some new myths right as they bud! On paper, and through past experience, several of the promised changes will surely introduce NEW inflation into the economy.

Trump’s threat to impose tariffs on things entering the U.S. after being produced in other countries will bring inflation. Trump admirers are now learning, post-election, that American consumers will be paying higher prices for imported items. That’s because a tariff essentially works like a sales tax.

We can anticipate even more inflation from the deportation of undocumented workers. Surveys by the American Immigration Council show that undocumented workers make up 13.7 percent of the U.S. labor forces in construction, 12.7 percent in agriculture, and 7.1 percent in hospitality. Just three states (California, Texas and Florida) host 47 percent of all undocumented immigrants and their economies rely heavily on these industries.

The current unemployment rate is just 4.1 percent, which means there are no workers available to step into roles vacated from deportation. That means new home and commercial construction will slow, pushing up the prices of existing homes and commercial spaces. Fruit and vegetable prices will rise, and the price of your hotel room for that once-in-a-lifetime Disney vacation will spike. Like tariffs, mass deportation will bring new costs to be borne by American consumers, and if your income doesn’t rise, your standard of living is going to fall.

The Fed, as it did in 2019 and after the onset of COVID in spring 2020, will compensate for a resurgence of inflation by raising the Federal Funds Rate. That means those who need to borrow will pay more, which will also increase the cost of living in your household and mine.

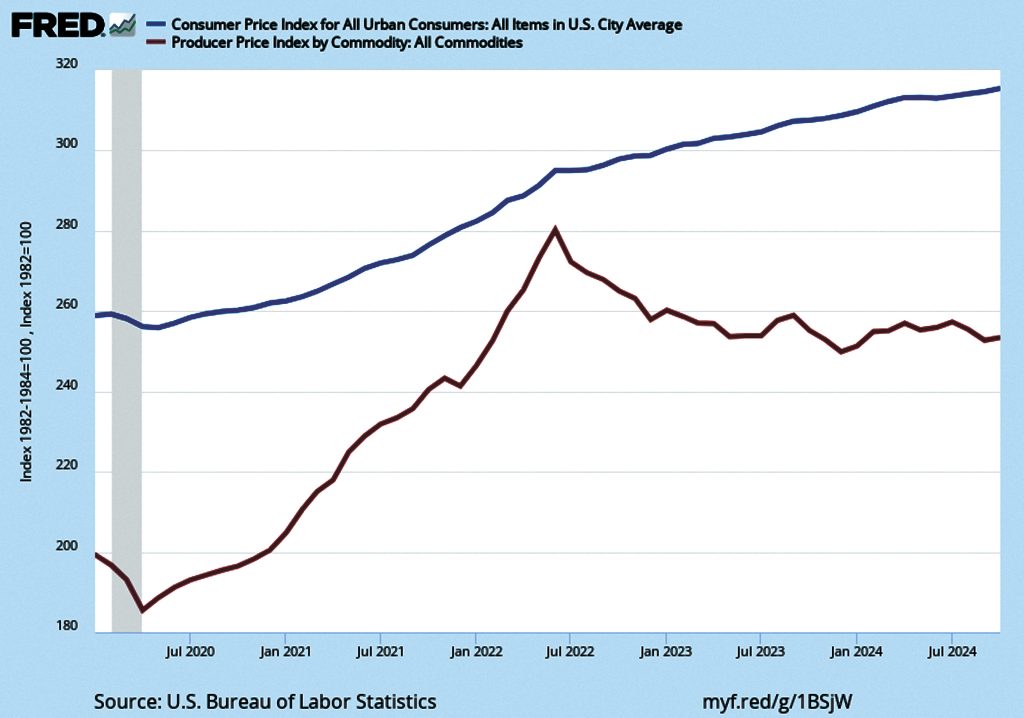

Enough of these potential scenarios from bad economic policies…let’s turn to the current inflation situation, which has seen steady improvement over the past year. We first saw the chart above from the Federal Reserve in my original inflation column six months ago.

The updated chart depicts inflation on two fronts: items that consumers purchase and items that producers need to make the things that consumers purchase. In economics, an index is used to measure changes over time from a starting date in the past. In this case, inflation is set at a starting point of 100 back in 1982, 1983 and 1984. So the index shows changes in the 40-year period from then until now. The numbers on the left side range from 180 to 320, or from slightly less than double the original 100 to slightly more than triple the original 100. The bottom of the chart shows time, from February 2020 (the onset of COVID) to the present.

The top line is the Consumer Price Index—a measure of the prices households pay for basic goods. Inflation has steadily increased for consumers, but at a slower rate recently. The bottom line shows the Producer Price Index, a measure of the prices businesses pay for the things they need to make and sell. Producer inflation has been more volatile, rising rapidly until June 2022, but falling sharply since. There’s actually been deflation (falling prices) in the Producer Price Index for two and a half years.

Taken together, the chart shows that consumers have continued to endure rising prices for food and household items as costs have continued to fall for producers. This discovery translates into some troubling conclusions.

First, as the prices businesses pay for the stuff they use to make stuff have fallen, producers have not reduced prices and passed the savings on to consumers. If they had done so, the Consumer Price Index would have returned to normal increases of less than 2 percent per year. Instead, most businesses have been enjoying a boom in their profits. In a word, they’ve been GREEDY. That shows up in surging stock prices on the NYSE and NASDAQ exchanges. As corporations report record earnings, the source of their gains is the lower cost of doing business joined to the higher prices they continue to charge consumers. This winning combination has resulted in extraordinary profits for businesses, but household pain for the rest of us.

The rise in the NYSE and NASDAQ exchanges to record levels is good news if you have a 401 retirement plan, or other holdings in the stock market. But more than half of U.S. households are living paycheck to paycheck, while the top 10 percent of the wealthiest Americans own 93 percent of the stock that’s in the exchanges.

We’ll learn more about the declining wealth and economic well-being of most Americans next time.

Larry Malone is professor emeritus of economics at Hartwick College.