Line 59: “Let me tell you how it will be.”

A commentary

IKEA opened its first northeast enormostore just outside of Newark, New Jersey, in 1990, at a time when the sales tax there stood at four percent. The company filled New York City subway cars with signs enticing the locals to take a ride over the bridge where they could buy all the things they need and save a bundle on sales tax (the combined New York state and city rate at the time hovering around eight percent). Legend has it Albany was none too pleased by this tax-evading subterfuge and instructed staff from the Tax Department to prowl IKEA’s parking lot to take pictures of New York license plates. They’d match DMV records to the photos and send a letter to the registered owner with a friendly reminder that if they had purchased anything while out-of-state, they were obliged to report that to New York and cough up the “use tax” they had evaded by shopping in New Jersey.

Over the years, we’ve heard occasional denials that such activity ever took place.

Of course it didn’t!

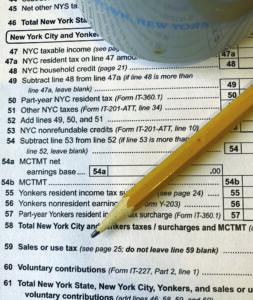

No, instead we have LINE 59 on our annual state income tax return. From the instruction booklet we read this declarative: Report your sales or use tax liability on this line. Do not leave Line 59 blank.

If you use store-bought tax return software and try to enter a zero on LINE 59, it comes back as an error.

I was present at the birth for Line 59, advocating for it in my previous life as the lobbyist for New York’s brick-and-mortar retailers. This was in the early 2000s when Internet-only merchants were starting to ransack the retail landscape through a massive advantage: decades of rulings from the U.S. Supreme Court prohibited states from requiring sellers with no physical presence in the state to collect sales and use tax when shipping merchandise into that state.

Never mind that we were paying, at the time, more for shipping and handling (or, in the case of IKEA, bridge and Turnpike tolls) than we would have had we just bought the thing in New York and paid the sales tax. The inarguable truth was (and remains) this: people hate paying sales tax.

Our job, however, was to bring some parity to the game and require those out-of-state sellers to abide by the same rules as our in-state Main Street merchants. Anti-taxers hit the rafters screaming that we were “taxing the Internet” (wrong) and that we were calling for a “new tax” (also wrong). We argued the state was leaving billions in sales tax revenue on the table and letting out-of-staters kill our downtown stores (right).

The state Senate’s Majority Leader at the time, an affable and defiantly tax-averse guy by the name of Joe Bruno, thought it a good idea to add a line to the state’s income tax return where New Yorkers could voluntarily enter the amount of tax they owe the state for buying tangible property in other states. Line 59. It worked, to a certain extent, but as the Internet exploded, we chipped away at the state’s sales tax rules until 2018, when the Supreme Court finally allowed states to level the sales tax playing field.

Now, when we buy whatever from Amazon or Wayfair or some other dot-com, we pay sales tax. Why, then, do we still have Line 59 growling at us? Its genesis is rooted in the state’s fear of losing out on sales tax from Internet purchases. We’ve put that to rest.

Ah, but the folks at the Tax Department cheerily remind us the beast is technically called the ‘sales and use tax’ and cite an example in the tax return instruction book: “You purchased a book on a trip to New Hampshire that you brought back to your residence in Nassau County, New York, for use there.” So, lucky New Yorker, you’re paying a tax not only on the sale, but also on our use of that book.

How nice.

Not that the state genuinely took pictures of New York license plates in a New Jersey shopping emporium or anything like that (of course they didn’t), but technically, yes, the original sales and use tax law does require us to come clean to New York when we buy tangible property in another state so we can, in good conscience, enjoy that book that was available only in a gift shop at Mount Rushmore.

Line 59 puts us on that path of taxpaying righteousness. Sorry about that.